Our Resources

Empowering You with Expert Tools and Guidance

At Venus Law Corporation, we strive to empower our clients with the tools and information needed to navigate real estate transactions and legal matters confidently. Explore our curated resources below to assist you in making informed decisions.

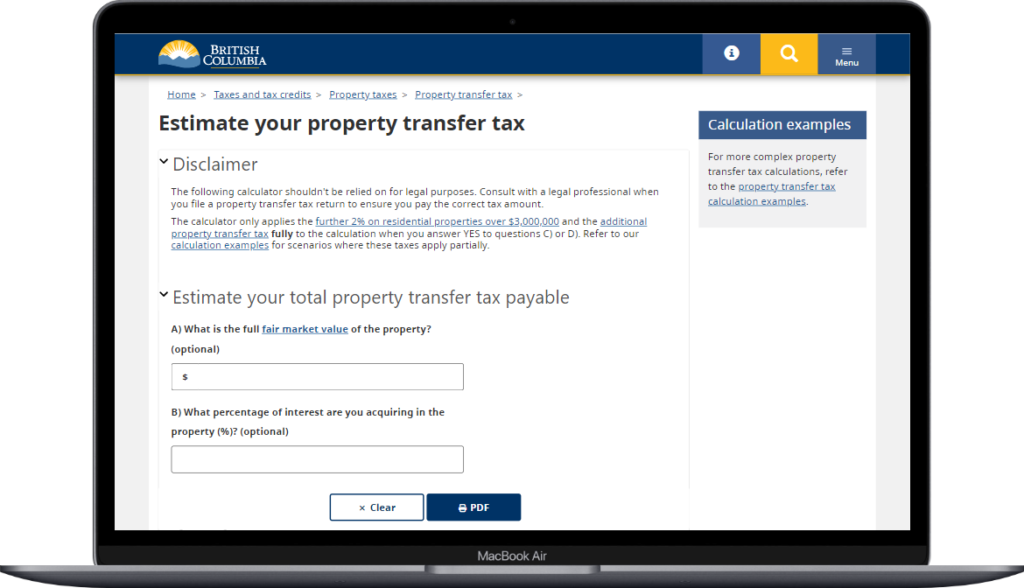

GST/PTT Calculator

Estimate the Property Transfer Tax (PTT) for your real estate transactions using the British Columbia Government’s Property Transfer Tax Calculator. Understanding your tax obligations is crucial for a smooth transaction. We recommend consulting with a legal professional when filing your property transfer tax return to ensure accuracy and compliance.

BC Real Estate Association Tax Calculator

Estimate the Property Transfer Tax (PTT) for your real estate transactions using the British Columbia Government’s Property Transfer Tax Calculator. Understanding your tax obligations is crucial for a smooth transaction. We recommend consulting with a legal professional when filing your property transfer tax return to ensure accuracy and compliance.

Get Started Today

If you need further assistance or personalized guidance, our team at Venus Law Corporation is here to help. Reach out to us to access more specialized resources tailored to your unique needs.

Frequently Asked Questions (FAQs)

Have questions? Our FAQs section addresses common inquiries related to real estate transactions, estate planning, and the legal services we offer. Find quick answers to help you better understand your needs and our processes.